How CBAM will lead us to a more sustainable global trading system

- Feb 13, 2024

- 2 min read

Updated: Feb 19, 2024

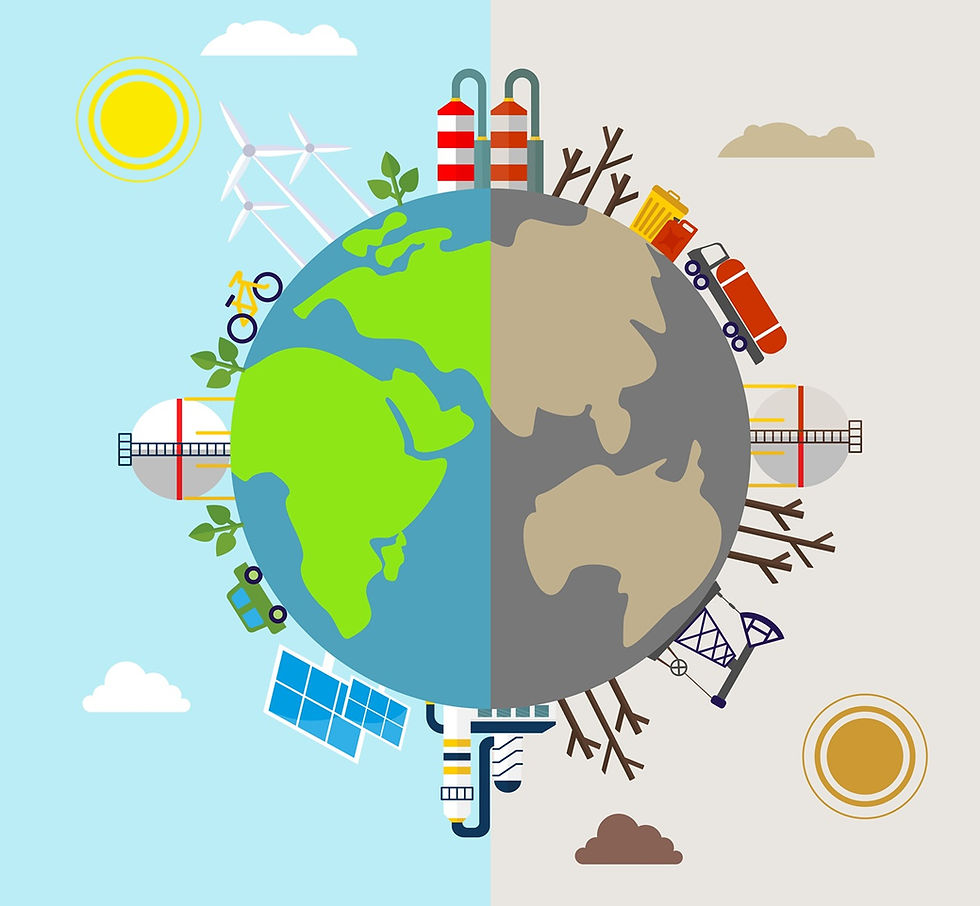

The term "carbon leakage" refers to the transfer of production processes with a high carbon footprint from the European Union (EU) to countries with lower or no environmental and climate commitments. This phenomenon poses a significant threat to the EU's efforts to combat climate change. In response, the European Union introduced the Carbon Border Adjustment Mechanism (CBAM) to impose a fair cost on carbon emissions associated with imports. This measure aims to ensure competitiveness while aligning with the EU's climate goals.

The CBAM is designed to determine the cost of carbon emissions in imported goods and encourage cleaner production practices globally, thereby safeguarding the EU's climate objectives.

Launched on October 1, 2023, the CBAM initially targets sectors with high carbon emissions, including cement, iron, steel, aluminum, fertilizers, electricity, and hydrogen production. By phasing out the EU Emissions Trading System (EU ETS), the CBAM seeks to minimize the risk of carbon leakage, making the carbon cost of imported goods comparable to domestic production. Consequently, European countries are incentivized to prioritize domestic products or import from non-European countries with equivalent carbon costs.

While the CBAM effectively addresses carbon leakage, its impact on global CO2 emissions is limited, addressing only 0.1% of the issue. Furthermore, its role in supporting decarbonization in developing countries is uncertain, necessitating more effective production and transportation processes. The United Nations Conference on Trade and Development (UNCTAD) urges the EU to complement the CBAM with additional measures to bridge the economic gap between developed and developing countries. Proposed measures include utilizing CBAM revenues to accelerate the adoption of cleaner production technologies in developing countries, thereby promoting a more comprehensive and environmentally friendly global trade system.

Under the CBAM regulations, importers are required to report total verified greenhouse gas (GHG) emissions quarterly, including details on both direct and indirect emissions incorporated into imported goods within a given calendar year.

From October 1, 2023, to December 31, 2025, importers must report these emissions regularly. CBAM fees will be managed through the purchase and delivery of CBAM certificates, invoiced based on the weekly averages of EU ETS auction rights.

At E-On Integration, we provide consulting services along with the utilization of the RIBIA GHG cloud platform. This enables companies to accurately record, calculate, and disclose all direct and indirect greenhouse gas emissions in an interactive and comprehensive manner. Additionally, E-On Integration has developed the RiskClima platform, which identifies and quantifies transitional climate change risks, including those related to changes in carbon tax legislation and evolving business obligations concerning climate risks.

Comments